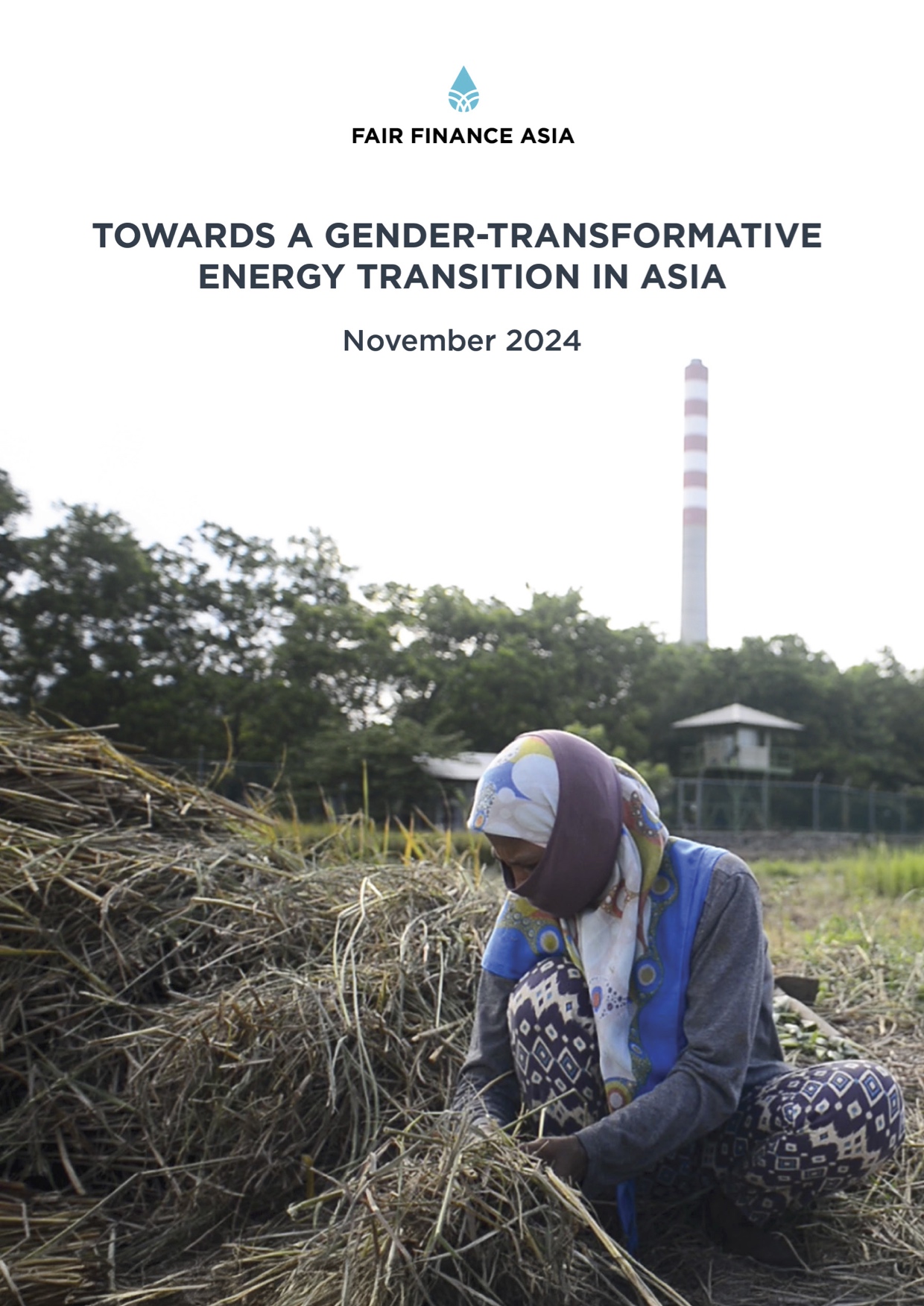

Launched on November 27, 2024, Fair Finance Asia's (FFA) new report, Towards a Gender-Transformative Energy Transition in Asia, reveals critical gaps in the consideration of gender equality and women’s empowerment in the early retirement of Cirebon 1 coal-fired power plant (CFPP) in Indonesia. The early retirement of Cirebon 1 is the first transaction under the Asian Development Bank’s Energy Transition Mechanism (ADB ETM).

Endorsed by Climate Action Network Southeast Asia (CANSEA), Global Alliance for Incinerator Alternatives (GAIA), Reclaim Finance, Recourse, Reality of Aid Asia-Pacific (RoA-AP), and Fair Finance International (FFI), FFA’s assessment considers Cirebon 1 an important case study for how the ADB’s ETM model identifies and assesses gender issues, and whether the ETM promotes gender equality and women’s empowerment. FFA urges the ADB to address the critical gaps in the gender considerations of the ADB’s ETM pilot in Cirebon 1, as a basis for improving the ETM’s implementation in other pilot countries.