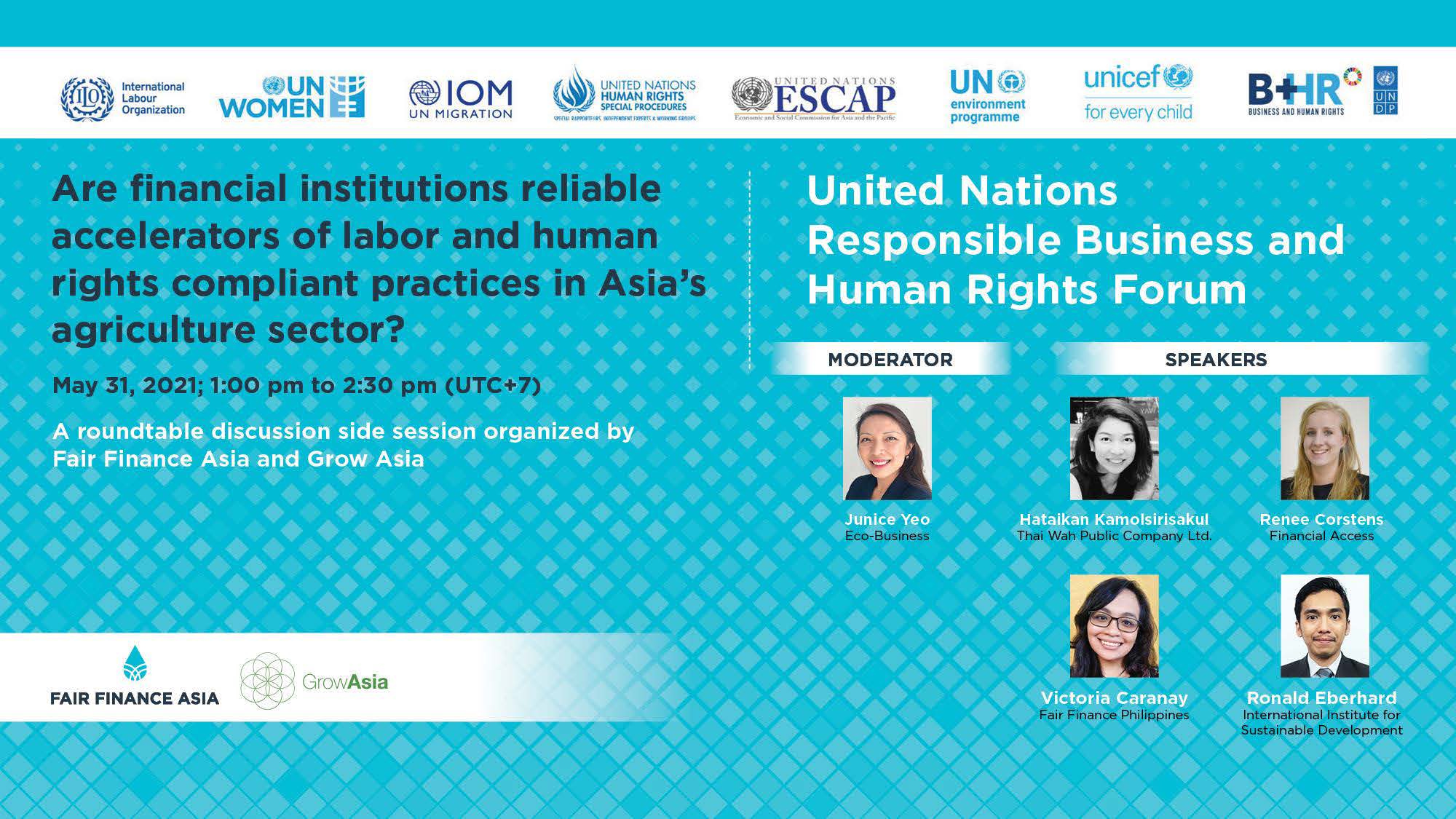

A roundtable discussion side session organized by Fair Finance Asia and Grow Asia

May 31, 2021 – At the United Nations Responsible Business and Human Rights Forum (UNRBHR Forum) 2021, Fair Finance Asia and Grow Asia organized a side session, ‘Are financial institutions reliable accelerators of labor and human rights compliant practices in Asia’s agriculture sector?’. This session – attended by over 500 participants – highlighted the key role of the public, private and financial sector in influencing positive change in accelerating the adoption of labor and human rights compliant practices across ASEAN’s agriculture sector.

Focus of the discussion

The dialogue was aimed at establishing the significant role and influence played by financial institutions and regulators in promoting labor and human rights compliant practices in Asia’s agriculture sector, and encouraging better coordination of initiatives in holding the Asian financial sector transparent and accountable. Facilitated by Junice Yeo, Executive Director of Eco-Business, our panel of experts was comprised of:

- Victoria Caranay, Economic Rights Programme Coordinator of Fair Finance Philippines

- Renee Corstens, Senior Agri-finance Advisor & Representative – Southeast Asia of Financial Access

- Ronald Eberhard, International Law Advisor, International Institute for Sustainable Development

- Hataikan Kamolsirisakul, Group Strategy and Innovation Director of Thai Wah Public Company Ltd.

Main discussion points

On holding financial institutions accountable

Engagement/advocacy needs to be done, especially with senior leadership within financial institutions. To get internal buy-in from the senior leadership, conversations on what is required by the government and society must be initiated, and having global standards and frameworks as the benchmark to assess progress regularly. Non-compliance to human rights standards can pose huge reputational risks and potential financial losses for both the banks and businesses.

Ms. Victoria Caranay stated, “One of Fair Finance Asia’s key interventions tool is the Fair Finance Guide International (FFGI) Methodology that assesses publicly available policies by banks vis-à-vis the global standards such as the IFC performance standards and OECD guidelines. In the first bank policy assessments of 5 Philippine banks done by the Philippine national coalition last year, for example, the average human right policy score was only 1.1 out of 10 with the front runner scoring 2.3 out of 10. In one of the Fair Finance Philippines’ case study findings, it was clear that there are labor and human rights violations in local farms. The response by financial institutions is that the responsibilities to these issues are not within their mandates, but the companies’. Fair Finance Asia aims to raise awareness from the advocacy standpoint that financial institutions hold key accountability for the human rights violations that take place through the projects and companies they support and invest in.”

On leveraging private sector responsibility

It is critical that agribusinesses promote the safety and improve the livelihood of the famers, their families, and the communities with the primary incentive to ensure that the end-to-end process benefit both the company and farmers, ‘work together to win together’.

Ms. Hataikan Kamolsirisakul highlighted, “It is our incentive to ensure the end-to-end output benefits both company and farmers by ‘working together to win together’. Working with farmers is not merely transactional. It is important to advise them on how to improve their yield such as introducing the right farming practices, (enabling) direct access to market for agricultural products such as biofertilizers and clean stems as well as higher yield crop varieties. We also assist farmers with technical support to manage across crop cycles through our Thai Wah digital farm management platform.”

On innovative ways to engage financial institutions

It is also noteworthy that the current economic impact of COVID has shown that sustainable businesses and funds could give the same or more returns than the regular ones, enable a more stable cross border and local funding in the region. National laws and legislations should include mandatory provisions of human and labor rights required to comply by the investors within certain measures such as the state contract with investors.

Based on Financial Access’s experiences working with the smallholder farmers and financial institutions and its recent report, Ms. Renee Corstens highlighted an example, wherein “ banks in Indonesia had hired young women from villages as their loan officers so that barriers in engaging with smallholder farmers in the loan processes are reduced.” She also mentioned, “Certification scheme and framework are the first step to create awareness among financial institutions, for example in Indonesia’s palm oil sector, the Small-scale Producer Organizations standard was included in the business with compliances to human, labor, and environmental rights. Moving forward, we can think of the use of technology in creating land mapping for formal land titles and more access to finance, for example.”

On coordinating initiatives in ASEAN

Adoption of human rights compliant practices in the region’s agriculture sector is still limited, and therefore, closer coordination by multi-stakeholder networks such as Fair Finance and Grow Asia are important in bridging the gaps. ASEAN governments should uphold human rights standards within their own countries, and join efforts with all relevant stakeholders to ensure cross-border compliance.

Mr. Ronald Eberhardindicated, “the ASEAN RAI guidelines could be used in three main different ways: 1) as the facilitation mechanism for sustainability such as the scoring system developed to assess how particular framework is complied with the international practices; 2) as an advocacy tool for influencing decision making by the governments, investors, and key decision makers to achieve responsible investment; 3) for risk assessment reduction in investments, reducing political and social risks of the investments and build higher returns for private sector under responsible investments. The guideline and the tool are publicly available for such evaluation and usage by the public to do their own diligences.”

For more details, the recording of the dialogue is accessible here.