On March 9, 2023, Fair Finance India, supported by Fair Finance Asia (FFA), will conduct a webinar that will bring together coalition members from Fair Finance India and the greater FFA and FFI networks, including research and advocacy partners at the national and regional levels, to discuss the implications of Environmental, Social, and Governance (ESG) disclosure, supply chain due diligence, and sustainability and monitoring standards.

In 2023, policymakers in India are focusing increasingly on supply chain monitoring, sustainability disclosures, and ESG certified investments. India’s regulators have been active in developing national standards for sustainability disclosures, notably with a stated regulatory intention of mandatorily expanding the Business Responsibility and Sustainability Reporting (BRSR) disclosure requirements from the top 1,000 listed companies to all companies in some form. More than 10 years have passed since India’s National Voluntary Guidelines, 2011, was introduced almost simultaneously as the United Nations Guiding Principles on Business and Human Rights – a journey that has taken Indian business through multiple economic cycles and standards such as the National Guidelines for Responsible Business Conduct (NGRBC), 2018, and the BRSR system. The BRSR reporting system stands at the end of the decade-long cycle of deriving standards wherein there is significant movement now to specify sectoral additions for these general disclosure requirements.

Fair Finance India has conducted a selected mapping study of bank policies for financial institutions that fund the garment sector suppliers in India. In this report, Fair Finance India set the context of their work in the sustainable financing of the garment sector by delving into the working conditions prevalent among large garment companies. Fair Finance India analysed the financial plumbing of these garment companies from FY 2017-18 and found that around half a dozen banks were linked as lenders to these companies. Using regulatory filings on responsible financing and a bespoke benchmark for garment sector financing, derived from the Fair Finance Guide International Methodology (FFGI), the report scores each bank on their public ESG reporting. In addition, Fair Finance India found that the garment companies consistently rely on loans from banks and that banks have a considerable interest in the garment sector, averaging around INR 660 crores in their exposure to the sample set. The existing reporting requirements also do not go far enough to provide a reliable picture of how ESG principles were satisfied before the sanction of loans. The banks in the sample set, on average, displayed a match of only around 27 percent to the benchmark requirements. These findings aim to provide a bird’s eye view of the gap between ESG reporting and ensuring sustainable outcomes for the Indian banking sector when it lends to garment sector companies. Fair Finance India’s report concludes by providing a set of next recommendations for various stakeholders to strengthen and make ESG reporting effective.

India’s presidency at the G20 platform in 2023 provides an opportunity to showcase advances made in these spaces at critical working groups focused on sustainability. At the same time, introduction and changes in extraterritorial regimes in the EU Mandatory Human Rights Due Diligence (MHRDD) and the OECD Guidelines on Multi-National Corporations, respectively, have the attention of all relevant stakeholders in terms of compliances and costs needed to execute operational transparency in supply chains. Financial institutions at various national and international levels are also starting to take note of these developments. This provides an opportunity to provide policy recommendations in various neighbouring, but distinct, sectors, such as supply chain mapping, due diligence, ESG and sustainability, all of which can add up to effective oversight of supply chains through consensus action.

The webinar’s objectives are to:

- Facilitate dialogue around the key findings and recommendations of Fair Finance India’s new report, “Mapping Garment Sector Funding in India,” specifically the limitations and challenges of conducting similar mapping exercises in Phase 2, and what Indian laws have to say about the responsibilities of financial institutions, how they are poised to change, and what international developments will move Indian discourse forward.

- Build knowledge and capacity related to national and extraterritorial laws and sustainability disclosure standards required for manufacturing industries.

- Identify the major bottlenecks in obtaining quality ESG disclosure data, as well as the legal structures and capacity building opportunities to overcome such bottlenecks.

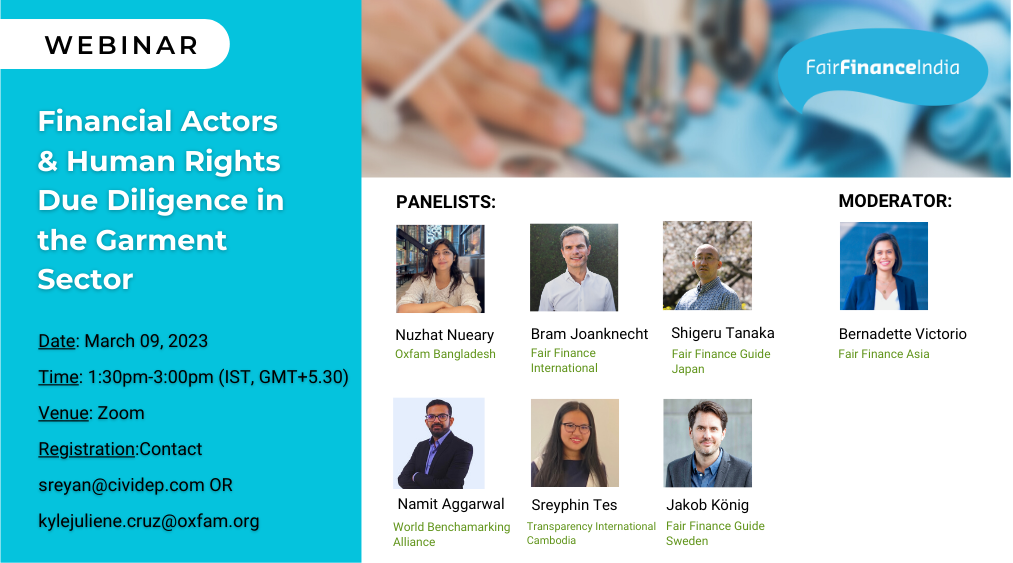

This webinar will be structured as a panel discussion. The webinar will open with introductory and scene-setting remarks by Bernadette Victorio, Program Lead, Fair Finance Asia and a presentation by Fair Finance India of its “Mapping Garment Sector Funding in India” report. Afterwards, Nuzhat Nueary, Programme Officer, Oxfam in Bangladesh and Sreyphin Tes, Programme Assistant for Business Integrity and Mining for Sustainable Develpoment, Transparency International Cambodia will be invited to speak about gaps and challenges in financial sector HRDD in their respective country contexts. Following sharing from countries, Jakob König, Project Lead and Research, Fair Finance Guide Sweden and Shigeru Tanaka, Executive Director, Pacific Asia Resource Center (PARC) and member of Fair Finance Guide Japan, will be invited to share their experiences in engaging their national financial institutions on HRDD issues regarding their overseas financing of garment sector companies. To supplement discussions, Namit Agarwal, Social Transformation Lead, World Benchmarking Alliance and Bram Joanknecht, Research and Advocacy Advisor, Fair Finance International will also be invited to share their insights on relevant initiatives to promote stronger HRDD, such as using international social benchmarks to put pressure on companies, as well as regulatory tools such as the EU’s CSDDD, respectively.

More information

To read the Concept Note, click here.

To read Fair Finance India’s “Mapping Garments Sector Funding in India” report, click here.