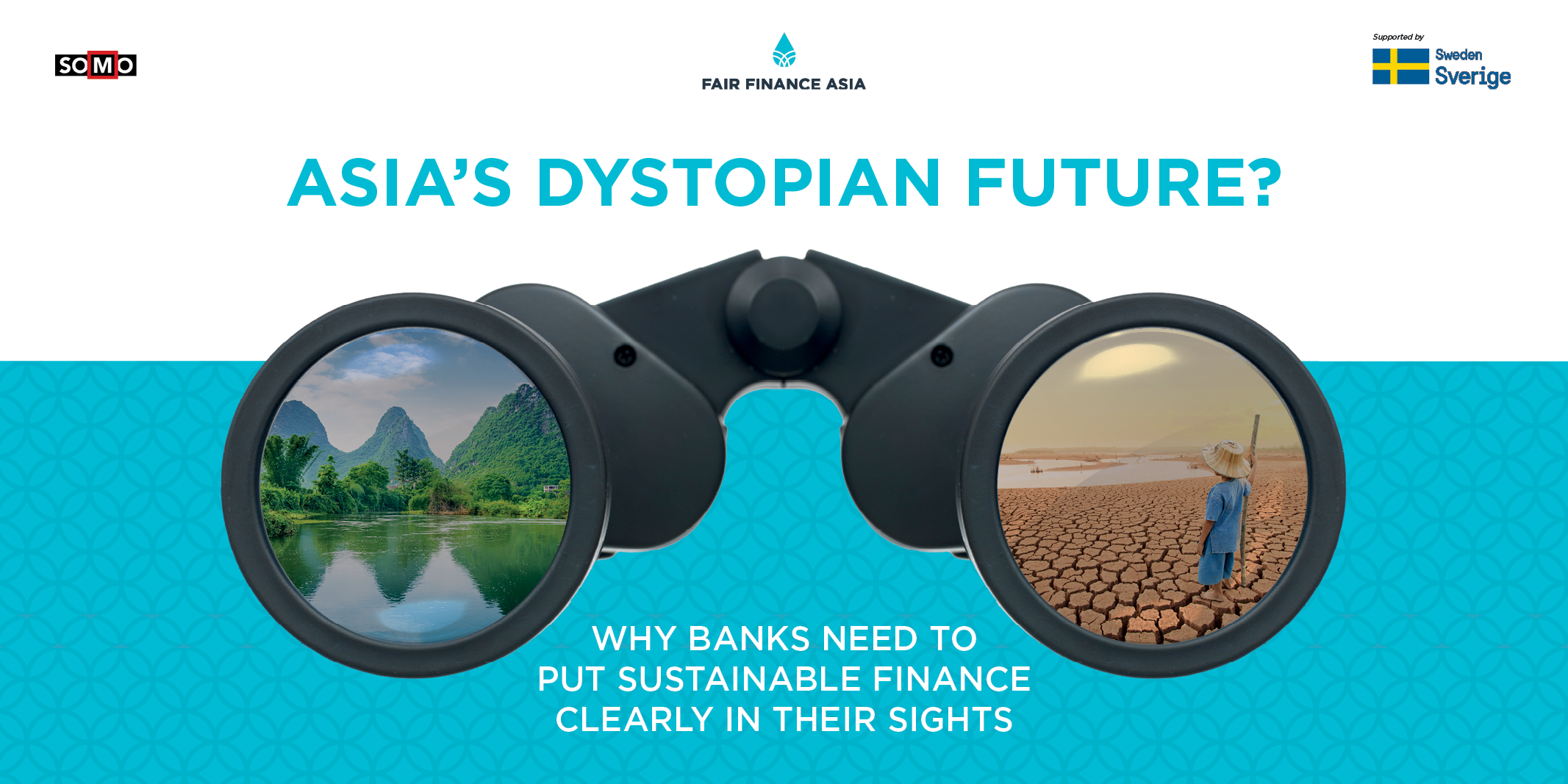

Exposing the worsening problems banks in ASEAN plus countries will face if they fail to make strategic contributions to environmentally and socially sustainable development by 2030, the Asia’s Dystopian Future study points to the critical need for regional cooperation to accelerate sustainable finance implementation in Asia

Fair Finance Asia, in partnership with SOMO (Centre for Multinational Corporations) today launched its report, ‘Asia’s Dystopian Future? – Why Banks Need To Put Sustainable Finance Clearly In Their Sights’, which exposes the worsening problems banks in ASEAN plus countries will face if they fail to make strategic contributions to environmentally and socially sustainable development in the next ten years. The report highlights the risks that banks operating in Asia will face if financial institutions continue with their financing practices in a ‘business as usual’ mode with little to no commitment to the sustainability of our societies, and provides concrete steps that financial institutions and regulators need to take in order to urgently redirect loans and underwriting services so they can directly benefit climate change mitigation, environmental resilience, and compliance towards human rights in Asia. Furthermore, the report points to the critical need for regional cooperation to accelerate sustainable finance implementation in the region, and calls on collective action as a way to deliver on shared commitment towards a sustainable future.

Pointing out the importance of such a report, Bernadette Victorio, Programme Lead of Fair Finance Asia, says, “The impacts of COVID-19 are testing the financial stability of Asian economies, but they also present an opportunity to change course towards greater sustainability. It is critical that banks in Asia no longer use the pandemic as a pretext to scale back on their commitments to support the Paris Agreement and Sustainable Development Goals, rather it should set the impetus for accelerated action. Fair Finance Asia developed this report to highlight the not so far future scenarios that we could expect to happen in Asia if little or no progress is made in the way the regional financial sector takes into account environmental and social considerations in their operations.”

The key highlights of the ‘Asia’s Dystopian Future? – Why Banks Need To Put Sustainable Finance Clearly In Their Sights’ study was presented to a selected group of Asian financial sector stakeholders during the roundtable dialogue, ‘Decade of Action: Banking on Asia’s Sustainable Future’. Fair Finance Asia and SOMO, in collaboration with Eco-Business, organized this roundtable dialogue on November 26, 2020, and it saw a participation of leading financial sector actors representing key Asian perspectives on sustainable finance from the industry, regulatory, and relevant international platforms. The study was well-received by participants and the dialogue provided an opportunity for regional stakeholders to formulate the first steps towards building meaningful synergies to accelerate impactful initiatives.

——————————————————————————————————————————————————————————

For more information, please contact:

Nirnita Talukdar

Policy and Communication Manager

Fair Finance Asia

E-mail: nirnita.talukdar@oxfam.org

About Fair Finance Asia

Fair Finance Asia is a regional network of civil society organizations (CSOs) committed to ensuring that financial institutions’ funding decisions in the region respect the social and environmental well-being of local communities. Seven countries within the region are a part of the FFA: Cambodia, Japan, India, Indonesia, Philippines, Thailand, and Vietnam.